The probability of a customer defaulting have also been given against each age group. These probabilities may be obtained from historical data, suitably adjusted for any circumstances that have changed since then. Estimated bad debt is simply the product of the probability of default and the receivable balance in each age group.

- Details of accounts receivable under each time group may also be accessed if needed.

- Accounts receivable aging is useful in determining the allowance for doubtful accounts.

- A best practice for businesses is to use an aging report to make an estimate of bad debts for each period.

- Depending on your policies, you can adjust these ranges as you see fit.

What is the approximate value of your cash savings and other investments?

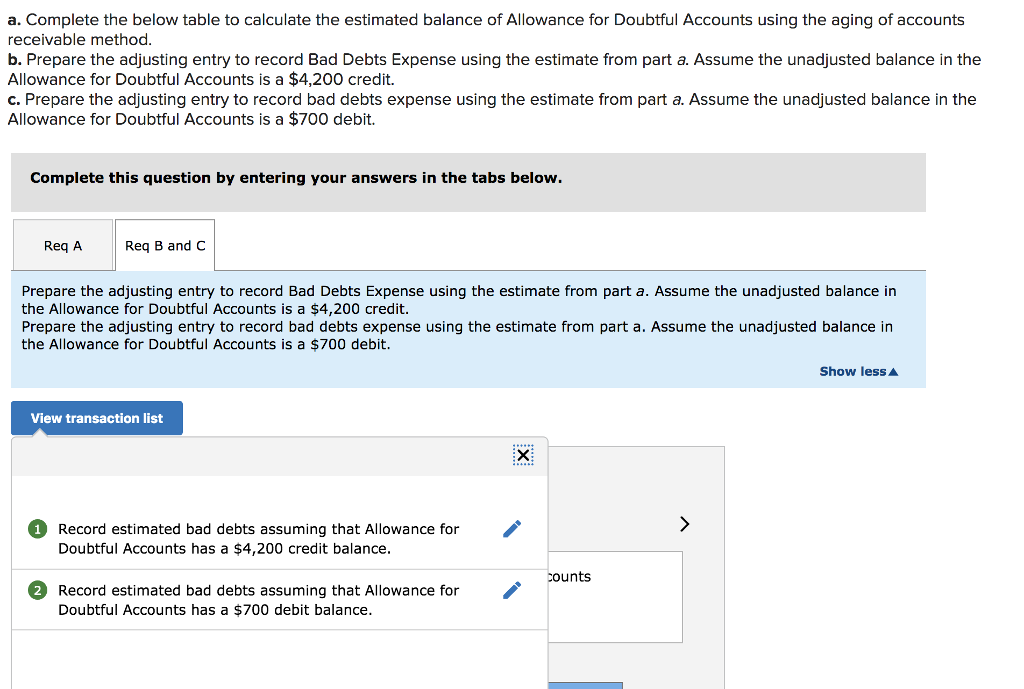

It focuses on the ending balance in the Allowance for Doubtful Accounts. In contrast, the percentage of sales method is an income statement approach that estimates uncollectible accounts as a percentage of total sales, focusing on revenue. Each method provides different insights into a company’s credit risk and financial health. Now let’s use the aging of receivables method for the allowance for doubtful accounts. In this method, we estimate the amount of uncollectible accounts in the ending balance of Accounts Receivable (AR) based on age, okay? So, instead of looking at the amount of sales, we’re going to look at how much is owed to us.

How an Aging Report Works

The specific receivables are aggregated at the bottom of the table to display the total receivables of a company, based on the number of days the invoice is past due. You may also want to adjust your credit policy by adding rules about interest. Adopting an interest policy may prevent customers from being too lax about paying their invoices. Bad Debt Expense increases (debit), and Allowance for DoubtfulAccounts increases (credit) for $22,911.50 ($458,230 × 5%). Thismeans that BWW believes $22,911.50 will be uncollectible debt.Let’s say that on April 8, it was determined that Customer RobertCraft’s account was uncollectible in the amount of $5,000.

How to Use the Aging of Accounts Receivable Method for Bad Debts

The method used to estimate the desired balance in the allowance account is called the aging of accounts receivable. Accounts receivable aging, as a management tool, can indicate that certain customers are becoming credit risks. It can be used to help determine whether the company should keep doing business with customers who are chronically late payers. If you notice that your customers often have overdue bills, you may want to consider revising your rules for extending credit.

Possible Problems in Aging Report

Aging can also be referred to as accounts receivable aging or an aging schedule. The outstanding balance of $2,000 that Craft did not repay willremain as bad debt. Accounting software will likely have a feature that generates the aging of accounts receivable.

Allowance for Doubtful Accounts Accounting Student Guide

Sandra Habiger is a Chartered Professional Accountant with a Bachelor’s Degree in Business Administration from the University of Washington. Sandra’s areas of focus include advising real estate agents, brokers, and investors. She supports small businesses in growing to their first six figures and beyond. Alongside her accounting practice, Sandra is a Money and Life Coach for women in business.

To prepare an accounts receivable aging report, you need to have the customer’s name, outstanding balance amount, and aging schedules. The final point relates to companies with very little exposureto the possibility of bad debts, typically, entities that rarelyoffer credit to its customers. Assuming that credit is not asignificant component of its sales, these sellers can also use thedirect write-off method.

The calculation matches bad debtwith related sales during the period. When the estimation isrecorded at the end of a period, the following entry occurs. The best method is with accounting software that lets you customize client settings, send automatic payment reminders, and get paid sooner. The aging schedule also identifies any recent changes or new problems in accounts receivable. This can provide the necessary answers to protect your business from cash flow problems.

The longer the time passes with a receivable unpaid,the lower the probability that it will get collected. An accountthat is 90 days overdue is more likely to be unpaid than an accountthat construction job costing is 30 days past due. Putting together regular accounts receivable aging reports, which you can easily do with invoicing software, allows you to identify regular late-paying customers.